In a Case of Mortgage Loan Delinquency It Is the

The 30-89 mortgage delinquency rate is a measure of early stage delinquencies and can be an early indicator of the mortgage markets overall health. Maes remedies in cases in which delinquency management is inadequate.

U S Residential Mortgage Delinquency Rates Download Scientific Diagram

In some cases there may be a grace period before the business loan is considered delinquent.

. Delinquent Mortgages and Foreclosures You are delinquent on your mortgage if you fail to make timely payments on the home loan. Borrowers who miss payments will often be subject to penalties and fees and may see a negative. Delinquency is measured because it indicates an increased risk of loss warnings of operational problems and may help predicting how much of the portfolio will eventually be lost because it never gets repaid.

Still the share of seriously delinquent mortgages 90 days delinquent was slightly above average at 283. Banks are insured US-chartered commercial banks. When a loan is delinquent that means the borrower failed to make their payment on time.

These interactive charts show the percentage of mortgages 3089 days delinquent in the US. This happens when your mortgage payment is past 30 days or more and didnt make it to the 15-day grace period given by the lender. The 673 figure is an amalgam of Fannie Mae Freddie Mac and various private portfolio loans and GNMA loans.

Recommended Get Matched With Local Licensed Loan and Foreclosure Lawyers Near You. Based on a 5 percent sample of residential mortgages since January 2008. As of August 31 2021 the rate was 833.

Adverse Delinquency 60 to 89 days past due. Besides that missing out on your mortgage payments can hurt. 03 down from 06 in October 2020.

But even though the total number of past-due loans rose 18 in February 2022 from a month earlier its essential to note that the delinquency rate. It captures borrowers that have missed one or two payments. Delinquent mortgage loans means x the portion of the mortgage loans that are delinquent for thirty 30 or more days and up to and including fifty-nine 59 days in excess of 3 of the aggregate repurchase price for all mortgage loans which are subject to then outstanding transactions and y any mortgage loan that is delinquent for sixty.

It can also be referred to as arrears or late payments measures the percentage of a loan portfolio at risk. By definition mortgage delinquency happens when a borrower fails to make his payments on time. Which is why its always smart for a borrower to be meet his financial responsibilities in order to avoid mortgage delinquency.

They are measured as a percentage of end-of-period loans. Are delinquency risks ie failure to pay the debt re- quired and the sudden increase in this risk in pre- vious years has been at the center of all crises in fi- nancial institutions. Loan delinquency simply means you have not made a payment on your mortgage for an extended amount of time.

Delinquencies have steadily fallen since recently peaking in Q2 2020 at 82. Ad Speak To A Local Licensed Loan and Foreclosure Attorney. In the case of mortgage delinquencies first-quarter.

Its important to note that major credit bureaus are generally notified of payment delinquencies of more than 30 days. When done repeatedly this could probably lead to foreclosure. Most mortgage contracts specify the exact terms of a delinquency up front.

The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 436 percent of all loans outstanding at the end of the first quarter of 2020 according to the Mortgage Bankers Associations MBA National Delinquency Survey. For example if you had a business loan with payments due on the first of each month the moment that due date passes the loan becomes delinquent. While some level of loan delinquency will be factored into every lenders operations if that level becomes too high it can have serious negative effects on your business including increased collection costs and reputational risk.

We would like to show you a description here but the site wont allow us. For every late payment is a corresponding late fee. We Fight For Your Home.

A delinquent mortgage is a home loan where the borrower is late in one or more required payments. 108 for Federal Housing Administration FHA-insured loans down from 147 a year. For example your mortgage may be delinquent if you have failed to make a payment for at least 90 days or owe more than 10000 in back payments.

This notice is required when payments are 45 days or more past due. According to the Mortgage Bankers Associations February 11 2021 delinquency report the overall mortgage loan delinquency rate was 673 for the fourth quarter of 2020. If youre behind on your payments your mortgage statement will include a delinquency notice.

Serious Delinquency 90 days or more past due including loans in foreclosure. The term Delinquent means a mortgage loan with a full monthly payment that is due but unpaid regardless of reason including loans in forbearance that. 22 down from 41 in October.

Special requirements related to the administration of HMBS pools can be found in MBS Guide Ch. Delinquent loans are a constant concern for lenders of all sizes. Delinquent loans are those past due thirty days or more and still accruing interest as well as those in nonaccrual status.

By loan type the share of mortgage loans delinquent in Q4 2021 was.

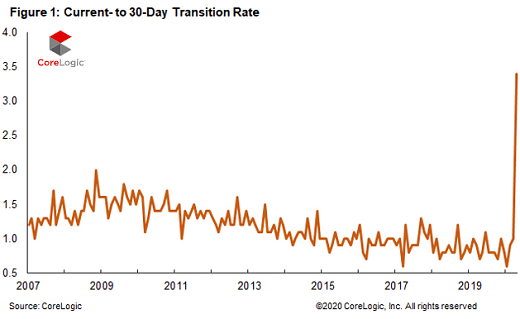

It Starts Mortgage Delinquencies Suddenly Soar At Record Pace Seeking Alpha

Corelogic Says Delinquency Transition Rates Continue To Improve Mortgage Mortgage Loans Rate

Mortgage Delinquency And Foreclosure In The Uk Vox Cepr Policy Portal

Comments

Post a Comment